Sustainability

Counting and sorting of used beverage containers is basically about improving our common environment and achieving a more sustainable future.

Profitability

Our experience and high expertise in circular economy also comprises the ability to advise our customers to choose the right solution so that their investment in counting and sorting systems becomes a profitable business.

Relationship-based cooperation

We have many years’ experience in close and long-standing cooperation with all customer segments and stakeholders.

Products

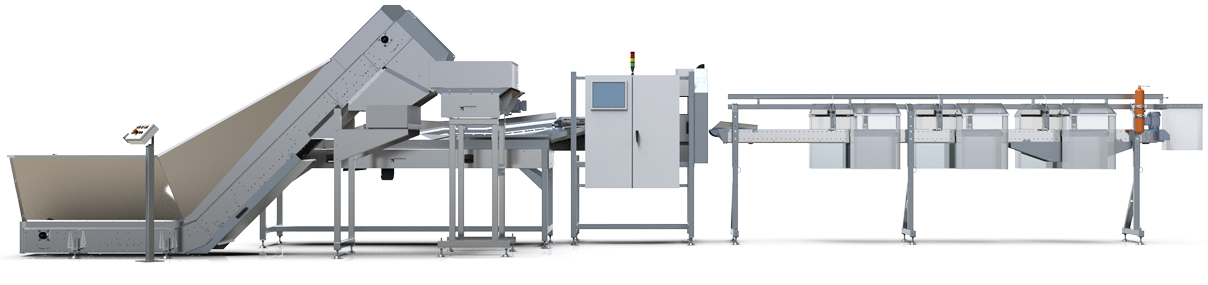

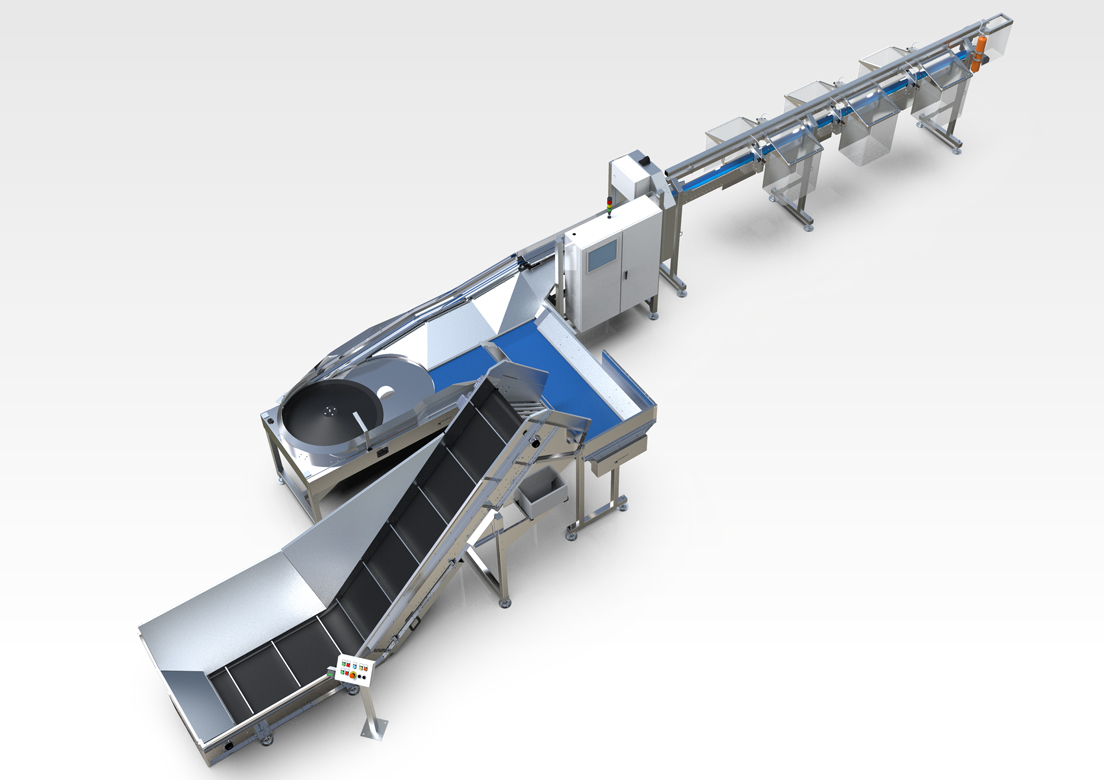

Our high performance HLZ® counting and sorting systems for all kind of beverage containers such as aluminum cans, glass bottles and plastic bottles can be operated by one person and are very user-friendly.

The HLZ® systems are installed in for example, bottle depots, car park solutions, counting centers, redemption and collection centers, which receive mixed batches of used beverage containers from retailers/consumers.

HLZ® is a registered trademark of Anker Andersen A/S.

Our modular designed HLZ® counting and sorting system

The cases stories are examples of how our HLZ® systems have been implemented in different markets

Drop & Go in Denmark

In cooperation with Dansk Retursystem A/S (operator of the Danish deposit and return scheme) we have developed a new deposit return system.

Regional Reycling in BC

Regional Recycling has chosen Anker Andersen equipment to their Quikcount systems all across British Columbia, Canada.

CLYNK in the United States

CLYNK relies on Anker Andersen HLZ® Ultra machines as a key component in the end-to-end CLYNK solution.

The First Cash & Go in Estonia

In the autumn of 2014 the national deposit system in Estonia (EPP) opened a bottle redemption center at the outskirts of Tallinn.

After Sales Care

After Sales Care - a valuable deal for your business.

We are recognized as a competent partner when advising stakeholders about DRS implementation globally

Contact

If you want to learn more about our HLZ® systems and how we work, please contact us.